|

|

Budget 2013: MSME sector to benefit

|

|

|

|

| Top Stories |

|

|

|

|

Bikky Khosla | 05 Mar, 2013

Last week, the 82nd national budget was presented in the Lok Sabha, and to the surprise of none, the postmortem is still going on. I think overall this Budget, in its attempt to balance politics and compulsions of growth, turns out to make some economic sense. Unlike a typical election year Budget, there are no big, eye-catching freebies - this itself is a refreshingly bold step; but neither the Budget, despite its talks about fiscal consolidation and national deficit control, can be termed as purely an economic reformer's budget due to its lack of direction here and there. However, overall, I see some positive developments in this Budget.

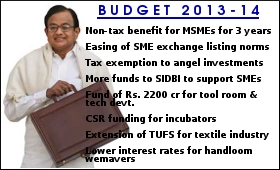

And as far as the interest of the micro, small and medium enterprise (MSME) sector is concerned, the Budget 2013 certainly brings some hope.

First of all, I think the proposal to make non-tax benefits available to the MSME units for three years after they graduate to a higher category is in line with the findings of the Economic Survey, which points out to strong concentration of micro (94.9%) and small enterprises (4.9%) and near non-existence of medium enterprises (0.2%) within the MSME sector. Majority of MSMEs find it unattractive to grow large in the fear of losing the concessions allotted only to the sector they belong to. Considering this, the Budget proposal seems quite practical.

In addition, the decision to ease SME exchange listing norms by permitting start-up companies to list on the exchange without going through the elaborate process of making an initial IPO would help facilitate investments for innovative and young start-ups. Similarly, the proposal to allow tax exemption to angel investments is a step in the right direction as angel investing is critical to the MSME sector, but here, however, I think the Budget is not clear enough on the norms.

In another decision and which again seems a well-thought out one, the Finance Minister announced that funds provided by corporates to academic incubators will come under CSR. This move will encourage investment in innovation.

Among other proposals, allotting SIDBI a corpus of Rs.500 crore to set up a credit guarantee fund for factoring and raising the refinancing capacity of the bank to Rs.10,000 crore sound good, but here I think releasing funds alone is not enough. The Economic Survey mentions that the country's large banks have bureaucratic procedures for loan approvals and SMEs suffer due to this. This issue is not something new, and recently FIEO has also raised the demand to bring the export loan disbursal by banks under scanner of independent audits. I agree with them - we urgently need a mechanism to deal with this challenge.

However, in terms of exports, I think the Budget 2013 puts a dampener on our expectations. Considering recent fall in overseas shipments and dull prospects ahead due to demand slump in global markets, I was expecting some strong support measures, but unfortunately there are not many apart from the benefits given to the textile sector. Exporters' hopes now hinge on the Finance Minister's promise that the FTP to be announced next month would address their concerns.

I invite your feedback on Budget 2013 and how you think it could affect your small business.

|

|

|

| |

|

|

|

|

|

|

|

Excise duty exemption limit

Sanjiv Sarnaik. spaclec@gmail.com | Sun Mar 10 10:02:43 2013

Why is Govt not considering the excise duty exemption limit enhancement from present 1.5 Cr to 3.0 Cr? The present limit has stagnated the MSME sector and is long overdue for enhancement. As long as GST is not introduced, this is a must.,

Appreciations for all texts

Mohammad Ali Shafiei | Sat Mar 9 08:52:23 2013

I am commercial manager of Esfahan hadid rah avard trading company based in Esfahan Iran, this to thank you for written such good and scientific texts for all matters

you are promoting every week, and they are really complete needs to be grateful for his / their efforts.

Woes abound

Ajay Sanghi | Thu Mar 7 10:57:44 2013

The facilitation Councils were kept pending in Rajasthan for more than one year by our Hon'ble Chief Minister. Our Hon'ble Chief Ministers have many conflicting demands to satisfy. There are so many pressure groups, and cronies, and persons of different castes, and then Central Higher-Ups nominees to take care of. These appointments are in the nature of QUANGOs ( Quasi Government doles) and it takes a brave CM to decide quickly. Better to keep the file pending so that everybody is kept on tenterhooks and not able to revolt openly. The MSMEs are, in any case, a bunch of trouble-makers, always clamouring for this or that, and they don't even have a vote-bank.

Is there any remedy for appeal against the delay by a Facilitation Council? I had lodged a case against Punjab State Electricity Board for 70 Lacs in overdue interest and the case is stuck with their Facilitation Council for over 24 months?

Cashew industry: stop free import policy

Prakash Mohan Das | Thu Mar 7 09:57:33 2013

Cashew industry as a whole is facing crisis because of processed cashew nuts from other countries. The main processing state Kerala is facing high market downwards. If this free import policy is not lifted for the processed cashews the industry which earns foreign currency to our country will be in great difficulties. This industry will not survive.

Budget should empower the business growth

Mohammed saleem - Brands Talk | Thu Mar 7 07:26:48 2013

Budget should give leverage to business which should include right from

Proprietor/ SME/ MSME: should provide loans without interest for 3 years, exempt from all taxes, which will bring more employment to the public at large.

Export: All taxes, concerning to export should be again relieved to proprietor, SME & MSME. This will bring in more income to the country and will raise the per capita income.

Education: Should be given concession, provided they reduce their donations, fee structure and attract foreigners to India and give quality education to Indians.

Infrastructure: exemption of taxes for the company dealing in the infrastructure likes, Roads, dams, Electricity, which every common people use in their life should be addressed.

Green Industries: Budget should give relief to those company who are into green products, whether it may be solar power energy, green technology, Green products which save the pollution, electricity, gas should be given exemption on taxes and provision of financial assistance and concession. Communication:unlike, food water, and shelter, today, communication is the basic needs, which include, telephone, internet and any other medium which help in the communication process should be exempted from taxes.

Taxation: any company dealing with growth of the economy should be allocated special privilege and financial support, relief on taxation guidance, to help the country indirectly by helping such organizations. Creative idea from brandstalk.in

Budget from MSME perspective

Ajay Sanghi | Thu Mar 7 05:34:33 2013

Your comments are appreciated.

The Budget has not highlighted the immense difficulty being faced by MSME's due to high interest rates. Secondly, a strong focus needs to be made on the timely payment mechanism as most Govt. Departments, Public Sector Undertakings, as well as Large Corporations are delaying the payments to manufacturers, who are unable to enforce the Provisions of the MSME Act due to rampant delays. If this is regularized and the Act becomes effective, it will be a great help to lacs of Enterprises struggling with cash flow problems and high interest burden.

On the positive side, the RBI move to allow new Banks is welcome, as the MSMEs will be better able to move out of the clutches of old-type conventional Banks which have charged usurious spreads over the years.

Budget 2013

Kamalakar Save | Thu Mar 7 05:31:54 2013

Dear sir,

Any planning document/budget including any government budget is of no use and consequence unless it is periodically analysed and compared for results and required actions are taken for course corrections in case of deviations. Finally at the end of the period the whole budget is compared in detail with the actual results obtained and then the performance ratings can be done.

Today with high computer technology it is possible t do the audit very correctly and during short intervals.

With this auditing process every department concerned is tested for the results and efficiency.

I think this budget exercise is very vague and open ended without any commitment and responsibility to achieve what is budgetted. This document must be considered a tool for utilising all available national resources to their fullest capacities and maximum efficiency, productivity.

Budget 2013 for MSME

Ashok | Thu Mar 7 05:19:13 2013

Its for Govt Not For Us Because if you want to take Sub-Sid in your Industry you may face more problems like monetary & Govt Document like drawing approve & other registrations because they demand high amount for proceed for that matter.And lease land is the main factor for take money of the higher officers

Woes of MSME sector

Pradeep Talnikar, Pune | Thu Mar 7 05:10:50 2013

We concur with the editorial comments. One more aspect in case of MSME remains always neglected is that FACILITATION COUNCILS which are mandatory to be formed by all state governments. It is observed that most of the state govt are reluctant to strengthen these councils. It is observed that in Maharashtra, councils are not functioning since past 4-5 months for want of approval of members' names by govt. The proposal is pending with Maha Govt since November 12. Can our organisation take up this issue with Ministry, if so, pl do the needful. We had sent email to the secretaries but there is no response.

Budget 2013 : SMEs

R K Bhatia | Thu Mar 7 03:59:38 2013

Very good editorial comments. However, SMEs most problems crop up from non-payment by big customers. Fin Min should provide for some fast track redressal of SMEs for such cases. In fact the legal process is so hazardous and time consuming that by the time some decision comes up, SME is already sunk - for revival and survival of SMEs this is must.

MSME

Sudhakar acharya | Thu Mar 7 03:26:53 2013

Sirs, with regard to the subject, I intend to start up a pre-cast elements near Hosur for small / medium size contractors. Please guide me to the financial institutions.

Pharma sector SME: impact of Budget

Dr. Pulastya Vora (Ahmedabad-based Pharma Consultant) | Thu Mar 7 02:14:31 2013

(1) Govt should not levy excise tax on AYUSH products

(2) On one side Govt. wants t give price benefits to patients by implementing DPCO but by itself does not want to do anything. If govt wants that patients should get medicines at affordable rates, it should come forward to make DPCO drugs free from all taxes.

(3) No encouragement is given to SMEs to come forward and launch new drug/ new drug combination/ new drug formulation. it seems that it is an arena of big pharma companies only.

(4) All DPCO products should be made available on single price through out the country

Loan is allowed only for pollution energy not for solar energy ?

Indrajeet Jain | Wed Mar 6 23:11:46 2013

All the scheme used to be launched only for governments employee 's relative and politician ..... not for normal SME . Politician and bureaucrat have always used SME as a weapons to rule nation with big corporate and these all three making their hand in the form of scheme? And India is going to be slab further . . . because people of India are not believing government ? I am from field of solar but here when I look corruption by government I got very depressed in spite global warming and climate change government loaning for thermal plant not to solar energy ?

SMEs unable to grow not because they don't want to grow

KRISHNA AGHORAM | Wed Mar 6 14:30:46 2013

Sir: I am sorry, I may like to disagree with your views on some of the following points:

a.Majority of MSMEs find it unattractive to grow large in the fear of losing the concessions - This is a very contradictory statement. On one hand when 94% of the MSMEs are micro, it goes without mention that they are unable to grow not because they do not want to grow, but because of the constraints of their either their over-dependence on Large Cos. (being an ancillary) or funds held up by large customers and other reasons, and NOT an act of purpose.

b.Angel Investors: I do not want to talk much about Angel investors poaching into MSME trade secrets and muscling them. It would have been prudent if Banks were to be persuaded to take care of this. Just because the Govt. is unable to direct Nationalized Banks to fund MSMEs, they are promoting Pvt. Angel Funds who will squeeze the MSME after buying into a huge percentage of their equity.

C. The SIDBI move seems fine with me.

D. Export measures are damp, as you said.

Regards

Krishna Aghoram

Avoiding the tow truck

Jaygee | Wed Mar 6 09:14:53 2013

The 82nd budget presented by the honorable finance minister reminds me of experiences while our vehicle has break down on a busy street and the antics we play to avoid the tow truck!

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

84.35

|

82.60 |

UK Pound

|

106.35

|

102.90 |

Euro

|

92.50

|

89.35 |

| Japanese

Yen |

55.05 |

53.40 |

| As on 12 Oct, 2024 |

|

|

| Daily Poll |

|

|

| Do you think Indian businesses will be negatively affected by Trump's America First Policy? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|