|

|

Budget 2010 - taking the middle path!

|

|

|

|

| Top Stories |

|

|

|

|

Bikky Khosla | 02 Mar, 2010

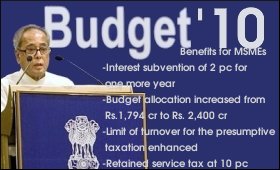

A lot has been said and discussed about Budget 2010-11, announced by Finance Minister Pranab Mukherjee on Friday. Considering the current economic situation of the country, the finance minister had a tough job in hand which he has, of course, performed quite admirably.

While he had to take measures that can set the pace for economic growth, he had other issues like social obligations and rising inflation to look into. The measures which were announced on Friday, ensured both. For instance, if we take up the case of Micro, Small and Medium Enterprises (MSMEs), we will see that the Budget has recognized the needs of the sector and in the coming days will help the sector grow positively.

I think the facility of quarterly returns and availing full credit on capital goods as proposed to MSMEs will indeed facilitate the working of this sector with more ease.

Although marginal, the proposed reduction of surcharge for Indian companies from 10 percent to 7.5 percent is also a welcome initiative.

The Budget proposes to introduce several provisions to grant tax benefits to small private limited companies desired to convert into Limited Liability Partnership (LLP), which is a welcome initiative.

Meanwhile SMEs will also benefit from the increase in the threshold limits for tax audit which are to be enhanced to Rs 60 lakh against the current ceiling of Rs 40 lakh, for business undertakings and Rs 15 lakh in cases of professionals.

I would say that this year's Budget has marked the long-term challenges of the SMEs by retaining the service tax at 10 percent and also by providing relief on central excise duties for MSMEs.

Increasing budget allocation for MSMEs and extending the interest subvention of 2 percent for one more year also came as good news for SMEs, thereâs no doubt about that.

Having said that, I'm a little disappointed with the budget for not taking the recommendations of MSME Task Force. The budget could have been more attractive for SMEs, had it given further incentives such as higher or rational tax depreciation on assets, progressive basis of taxation like individuals and several such benefits.

|

|

|

| |

|

|

|

|

|

|

|

Budget for MSME.

Milan Mehta | Fri Mar 5 07:39:47 2010

Dear Bikky,

Thanks for the excellent gist of the Budget in view of MSME perspective.

However important is now the States Budget which should also increase the exemption limit for Sales Tax Audit on similar rational thinking to 60 Lakhs.( as far as our Maharashtra State is concerned ).

To bring all Unregistered MSME units into the fold of MSME, Govt. lost the golden opportunity of giving extra exemption in Income Tax Audit by 10 - 20 lakhs to all those MSME Units who are registered with DIC Office in respective states by filing EM2.

It would have serve as motivating factor for new units also to get immediately registered to avail of benefits by filing EM1.

I am sure that whatever facilities are presently given / extended, MSME shall get the extra fillip to perform once Budget gets officially passed in Parliament.

Milan Mehta

H.Secy,AISSCMA.

Member, BSSIA.

P.S: The views expressed herein are personal and do not reflect the opinion of the Associations.

Interest subvention of 2 % for MSME

Divya International | Thu Mar 4 08:19:51 2010

The banks are not offering these rates to all MSME's only those under specific categories and asking for MSNE certificate any information on how and from where such certifiction can be obtained

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

84.35

|

82.60 |

UK Pound

|

106.35

|

102.90 |

Euro

|

92.50

|

89.35 |

| Japanese

Yen |

55.05 |

53.40 |

| As on 12 Oct, 2024 |

|

|

| Daily Poll |

|

|

| Do you think Indian businesses will be negatively affected by Trump's America First Policy? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|