|

|

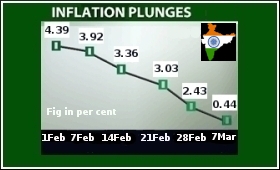

With inflation at record low, slash in interest rates should follow

|

|

|

|

| Top Stories |

|

|

|

|

Bikky Khosla | 24 Mar, 2009

With the inflation rate dipping to a historic low of 0.44 percent last week from a 15-year high of about 13 percent till September 2008, the economy stands to face the side-effects of deflation. Already consumer sentiments have dropped drastically due to the global slowdown and with banks still wary of lending, the economy may go into deep-freeze if corrective measures are not taken now.

The worst part is that despite the banking and financial system having enough liquidity, they are not releasing it for fear of defaults. Banks now have to come forward and lend to keep the growth momentum ticking. Although the Reserve Bank of India (RBI) has been loosening up the monetary policy, I feel it's not enough by any means. What India Inc. needs is more aggressive easing of the monetary policy.

It is my feeling that to inject this much-needed confidence in banks, RBI will now have to play an active role. It needs to take advantage of the 0.44 percent inflation rate and curtail prime lending rates and thus remove sluggishness in demand. There is scope for economic expansion even at times of meltdown if the apex bank takes these steps. It's now up to the RBI to see that it takes measures that will not only ensure economic expansion, but will also help the economy to bounce back.

Even industry stalwarts are of the opinion that: '...given the present inflation rate and the interest rates being charged by banks, the real rate of interest in the economy continues to be at double digits. The banks must lower the lending rates to single digit levels if economic activity is to be stimulated.'

Moreover, even to create consumer demand, interest rates must come down and should be made affordable for homes, cars and other consumer durable products. Owing to the current high interest rates, buyers are avoiding purchases in the hope that interest rates would moderate soon. This is creating a negative impact on demand for products, which in turn, is affecting production.

To spur up demand there has to be a further slash in interest rates, no doubt about that. Doing so will ensure that the recessionary trends in demand and consumption pattern will slowly and gradually phase out.

The question is, when are we going to see these measures come into force? Let's keep our fingers crossed till the good news comes along!

|

|

|

| |

|

|

|

|

|

|

|

interest rates

ashwin | Tue Mar 31 06:11:43 2009

The question really is why aren't the rates coming down ? If it will help small time exporters like us is not the issue. Mainly because we have never ever had any help whatsoever for our survival. To expect any help now is living in dream world.

Slash in interest rates

K.Krishnananda | Thu Mar 26 07:56:26 2009

Dear Mr. Khosla,

Many of your suggestions and observation are very much opt. I believe decision makers in the government sectors /provite sectors should take note of it and implement to suite their needs which I feel will give some impetus to the sagging economy.

managing the economy

b v rao | Wed Mar 25 10:25:44 2009

Let us all join in managing the economy. One way is to boycott Chinese products for following reasons:

1. China attacked India in 1962 and is not yet repentant on the same.

2. It crushed Tibetans.

3. It is claiming Arunachal as its

4. It has no transparent systems and labor welfares like in India.

5. Remember that it poisoned the milk to its own citizens !

6. It produces toys with mercury harmful for the chilren and banned in USA.

7. I have seen the reports of its product failures in CR4 website

The boycott should be arranged by the citizens without govt involvement

|

|

Re: managing the economy

Vinay Fotedar KSA | Wed Mar 25 10:54:15 2009

Slash in interest rates will not help. Economy is going thru a recession and bottom is yet to be experienced. If inflation rate is dropping is not because of price but because of drop in demand. So think tanks have to figure out how to increase demand.

|

|

|

|

Re: Re: managing the economy

Suhel Subhani,Meerut | Thu Mar 26 19:19:33 2009

Instead of slashing interest rates the Govt should ease the norms of lending banks. Generally the R.B.I. has fixed that if a customer fails to repay his loan for 3 consequtive months then the bank has a right to take over the property. This clause is really a barrier in this turbulent times when the people are loosing their jobs and business atmosphere is uncertain.

The Govt should now take corrective measure and should not allow bank to take over the properties of any errant customer if the cause is geniune.

This will surely help to boost demand not only in housing sector but also in other sectors too.

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

84.35

|

82.60 |

UK Pound

|

106.35

|

102.90 |

Euro

|

92.50

|

89.35 |

| Japanese

Yen |

55.05 |

53.40 |

| As on 12 Oct, 2024 |

|

|

| Daily Poll |

|

|

| Do you think Indian businesses will be negatively affected by Trump's America First Policy? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|