|

|

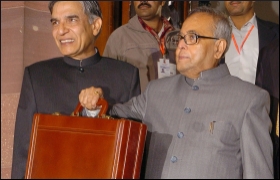

Interim Budget 2009 - with polls ahead, recession issues take backseat

|

|

|

|

| Top Stories |

|

|

|

|

Bikky Khosla | 17 Feb, 2009

Well, the expectations from the Interim Budget, or more precisely, vote-on-account were low and the acting Finance Minister, not surprisingly, lived up to the expectations.

With General Elections not far from now, the government had its eyes fixed on social issues, especially those concerning the aam admi.

Although the Industry and the equity markets gave the thumbs down to Pranab Mukerejee's Budget, there were, however, certain reasons to cheer about too. The increase in the funds flowing into infrastructure projects and the social sector for one, is a good move. This will certainly help the economy get out of the current economic stagnation.

On the export front, the extension of subsidy on interest of credit for labour-intensive export units till September-end can be seen as a positive sign too.

The interest subvention of 2 percent - specifically on interest on pre- and post-shipment credit for employment-oriented sectors - will now be extended beyond March 31 till September 30. It will be beneficial for sectors like textiles, carpets, leather, gems and jewelry, marine products and other small and medium enterprises (SMEs).

However, the Budget lacked sector specific tax incentives for segments such as housing, steel, cement, consumer durables, and passenger cars, etc., which have high output and are also employment intensities. The government didn't consider certain recommendations of the industry including five-year holiday in payment of Income Tax for the garment exporters, two-year moratorium from the payment of term loan and interest, exemption of exporters from the payment of all Service Tax and Fringe Benefit Tax instead of giving refund of tax paid on few services, etc.

Considering that export growth declined to 17.1% in the first nine months and job losses to the tune of 1.5 million, the government's failure to announce measures for the ailing exporting sector is surprising, to say the least. Add to that the failure to increase duty drawback rates by four percent to beat growing competition in gloomy overseas markets as recommended by the industry.

All in all, the Budget lacked a slew of measures from the government that could have rejuvenated the economy to overcome the demand slump accruing from the global meltdown in the current situation.

|

|

|

| |

|

|

|

|

|

|

|

biki's editoial

allan d'souza | Mon Feb 23 06:13:13 2009

the budget provided for needless mega spending on external defense, little allocation for internal security, and zero

for the pay commission.

very sad but true.

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

84.35

|

82.60 |

UK Pound

|

106.35

|

102.90 |

Euro

|

92.50

|

89.35 |

| Japanese

Yen |

55.05 |

53.40 |

| As on 12 Oct, 2024 |

|

|

| Daily Poll |

|

|

| Do you think Indian businesses will be negatively affected by Trump's America First Policy? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|