|

|

Food inflation climbs to 17.7 percent

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 08 Apr, 2010

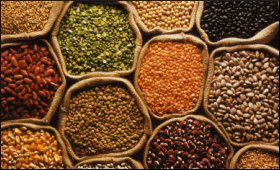

Annual food inflation rose to 17.7 percent for the week ended March 27 from 16.35 percent a week before owing to a rise in the prices of milk, fruits, vegetables and lentils.

According to data on the wholesale price index released Thursday by the commerce and industry ministry, the index for food articles rose 0.9 percent during the week under review, while that for non-food articles fell 0.2 percent.

Taking into account the year as a whole, the prices of wheat, lentils, fruit, milk and non-food articles like fibre and fuel were ruling sharply higher than the levels seen last year. However rice, onions and potato became cheaper.

Following are the prices of some essential food items over the 52-week period:

- Pulses: 32.6 percent

- Potatoes: (-)17.71 percent

- Vegetables: (-)1.75 percent

- Milk: 21.12 percent

- Wheat: 13.34 percent

- Cereals: 10.92 percent

- Onions: (-)14.18 percent

- Fruits: 14.95 percent

- Rice: 8.80 percent

It is in contrast to the assessment of the government which said April 2 that steps taken to control prices of food articles had started yielding results and prices of many food articles had either declined or remained steady over the last one week.

The central bank has initiated measures to tighten its monetary policy by hiking key rates in a bid to suck out excess liquidity from the system and tame inflationary expectations.

"Inflation pressure is stronger than we anticipated. Between November 2009 and February 2010, in a space of four months, the wholesale price inflation has gone from 5.6 percent to 9.9 percent," Reserve Bank of India (RBI) Governor D. Subbarao said early last week.

"We have constantly maintained about the need for exiting from the expansionary monetary policy. We have also been saying all along that we need to exit in India ahead of other countries because of the growth-inflation trade-off we are facing," he said.

Analysts say the government's decision to raise auto fuel prices in major cities from last week is likely to stoke inflationary pressures further and the RBI would raise rates for the second time in as many month in its April policy review.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

84.35

|

82.60 |

UK Pound

|

106.35

|

102.90 |

Euro

|

92.50

|

89.35 |

| Japanese

Yen |

55.05 |

53.40 |

| As on 12 Oct, 2024 |

|

|

| Daily Poll |

|

|

| Do you think Indian businesses will be negatively affected by Trump's America First Policy? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|